This is a sponsored post by UnitedHealthcare. All thoughts and opinions are my own.

In my previous post on small business health insurance, I talked about how easy it was to get a quote for your company. This one will show the three steps to navigate the site and get the information any owner needs to make an effective decision in less than 20 minutes. Most importantly, this simple process helps the owner understand the health insurance they are buying. In addition, if the company offers employees at least six plans to choose from, they can use the Fit Finder Tool.

Start by entering basic information to allow the site to find the best plans in any specified geographic area. This includes the location zip code, number of employees and projected start date of the small business health insurance.

The next steps are divided into three sections:

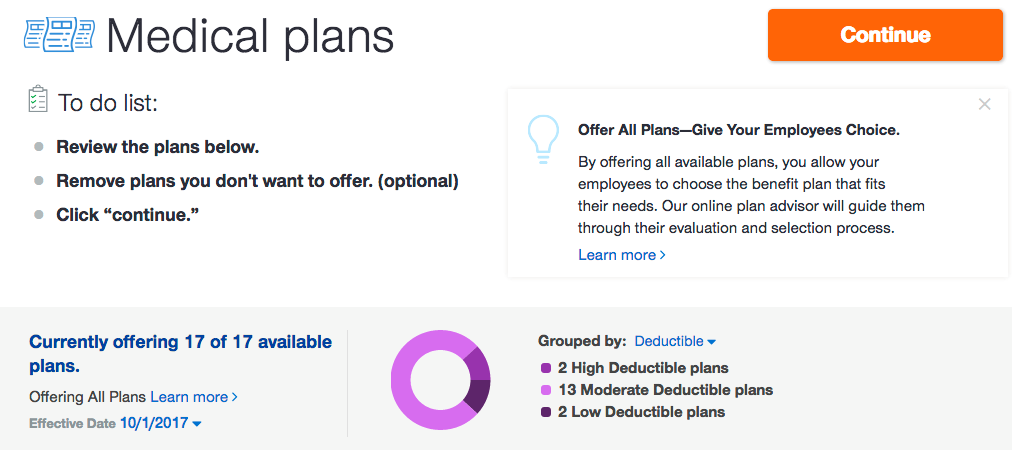

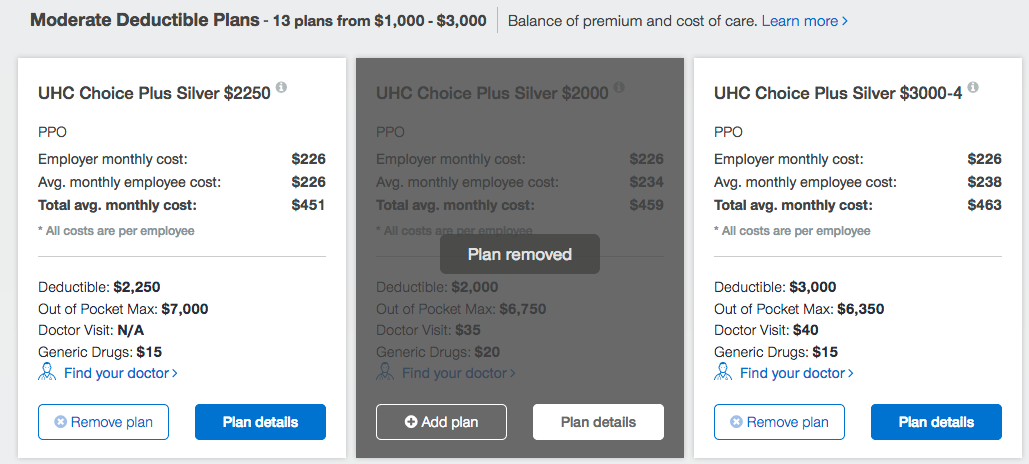

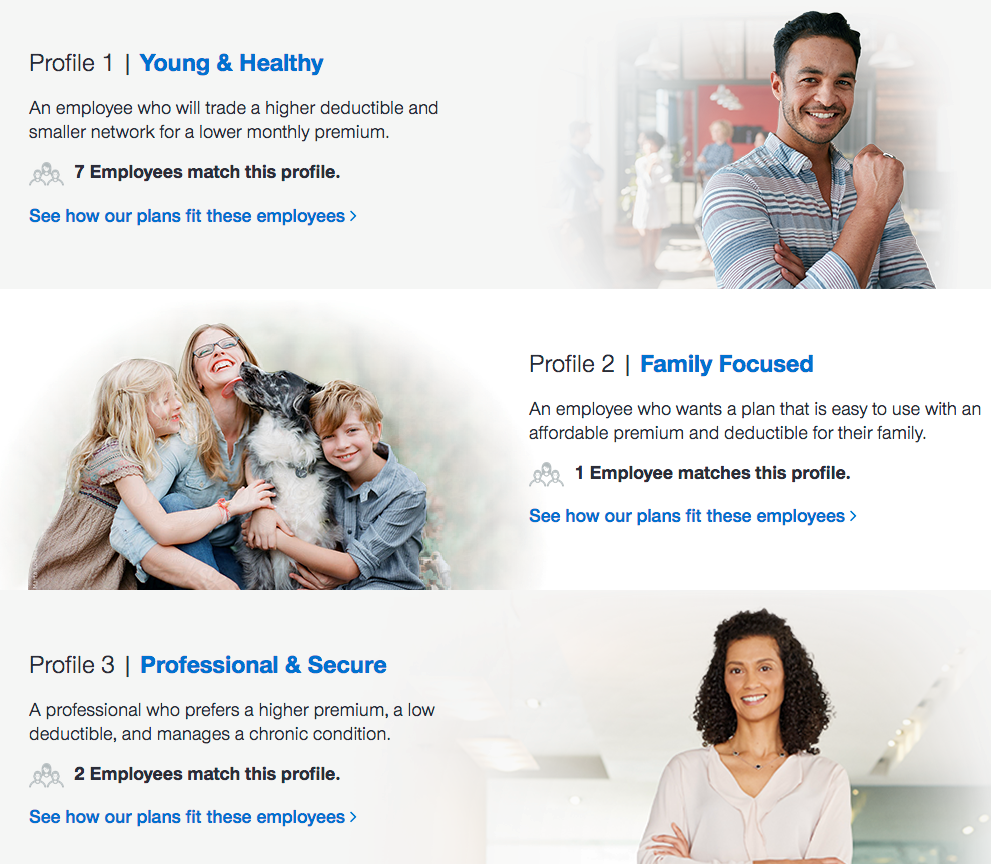

- Medical plans. With the basic information, the owner can now choose which to offer their employees. They can review all available plans and remove ones they don’t want. The site lets employers have the option to explore common “employee profiles” to better understand employees’ lifestyles and gain insight into their insurance needs (young and healthy, family focused, professional and secure). Small business health insurance choices can also be based on the level of deductible or targeted health care network.

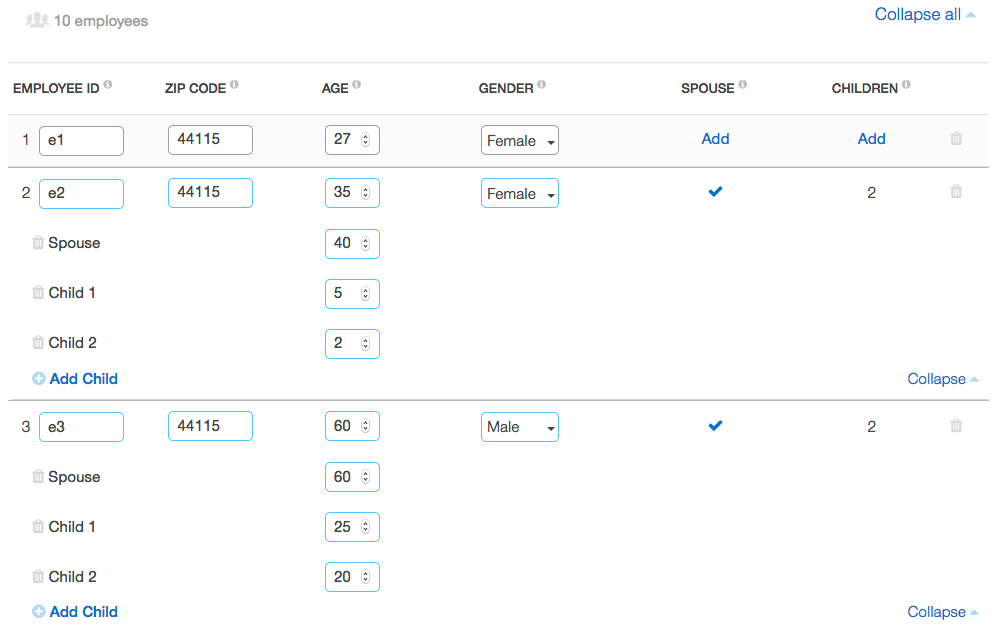

- Employee details. Basic employee information can be typed in or imported from software like Xero, Excel or QuickBooks. Details to be included are employee initials, their zip code, age, gender, and optional claimed dependents.

- Monthly budgets. The owner can then set the budget amount they want to pay small business health insurance each month using an interactive slider tool. This way, employees can choose the plan that works best for them and pay the difference. For the owner’s convenience, a total cost breakdown is provided (employer and employee share).

At the end, an account can be created to review, edit, share and check out. An online coverage advisor is always there to help with all of this. I am currently a UnitedHealthcare client and have been very satisfied with their coverage. I suggest you check out this tool as an excellent alternative when looking for small business health insurance.

The views expressed do not reflect those of UnitedHealthcare nor its affiliates. They are the personal opinions of the authors. While UnitedHealthcare has made every attempt to ensure accuracy, the information contained in these blogs may change and UnitedHealthcare assumes no responsibility for errors, omissions, contrary interpretations of the subject matter or information herein or for any losses, injuries, or damages arising from its display or use. These blogs may connect to other websites maintained by third parties over whom UnitedHealthcare has no control. UnitedHealthcare makes no representations as to accuracy, completeness, suitability, or validity of any information contained in those linked blogs or third-party websites. Blogs are for general informational purposes only and not intended to be medical advice or a substitute for professional health care.