What it means for 2018:

- Owners may get lower taxes. Most small businesses are structured as pass through entities like “S” and “LLC” corporations. That means, in the past, any income from these companies were taxed at the owner’s individual tax rates. The new law may promote pass-through corporations since these rates will be lower than ones for individual income taxes since owners now will now be able to deduct 20 percent off their earnings before paying taxes on it. Make no mistake, this is still a higher tax rate than the 21% that large corporations will be paying. The numbers seem similar, but for small business owners it is a deduction off earnings while for large corporations, it’s their entire tax rate.

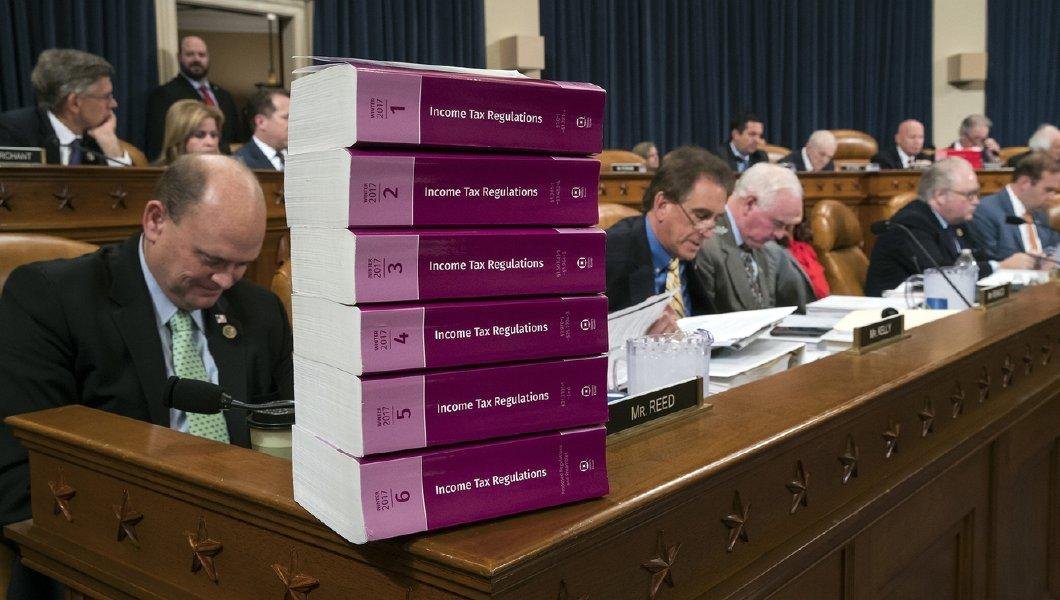

- Check the limits. The law includes limits on who can take the deduction, but they would not begin until $157,500 in taxable income for singles and $315,000 for couples. Most “non-business” pass-through filers make less than that and would qualify for the full 20 percent deduction. However individual tax rates for those making between $200,000 and about $425,000 will actually go up from 35% to 37% so some small business owners could face an increase. Forget about this being simple. As Forbes states, the math is very complicated and the accountants are jumping for joy!

- Value of your home will go down. Real estate prices are projected to fall 5% to 10% especially in the geographies where the new tax law makes it less advantageous to own a home. This will especially be true in urban real estate locations where property and local taxes are high since there is now a limit to tax deductibility of these items. A home is typically the small business owner’s largest asset and may hurt their ability to borrow capital for their company. While mass migrations of customers to lower taxed states is not expected, this may be another way local retail businesses may be hurt yet again in 2018.

What actions need to be taken this year:

- Push or pull. Based on the owner’s projected income, either bring profit or push it out for next year. Unfortunately, this will not be that clear to determine given the new complicated tax structure for small business owners.

- Pay individual property, local taxes or mortgage interest in advance. There are limits on deductibility in 2018 so take advantage of this now.

Of course, talk to your tax advisor before taking any of my advice!