All companies go out of business for the same reason: They run out of cash. This is the single biggest concern that keeps many owners up at night. While they know this fact, they are never able to implement a cash flow tool to track their weekly or monthly activity that reflects this importance.

Many accounting systems will produce a cash flow statement of what has happened in the past, but few have one that can accurately predict future cash flow needs. This leaves the small business owner with constructing a rudimentary model with Excel or paying their accountant to make one for them that they constantly must manually update.

This has all changed with the introduction of a new amazing tool I discovered called Finagraph’s CashFlowTool.com. It’s an easy add on to QuickBooks that can forecast a company’s cash flow tomorrow or next month based on historical data and projected payments. I used it in my business and I was amazed how insightful it was.

It is simple to get started. Sign up for a free trial or go to the App store or Google Play. Then download the Chrome extension and link it to your QuickBooks file. This entire process to get this cash flow tool took about 5 minutes to link my 15 years of company data to Flight.

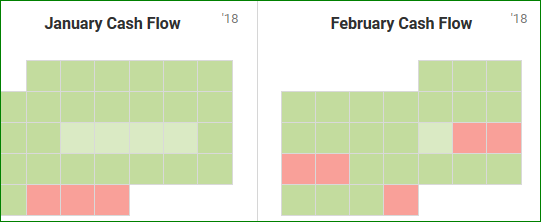

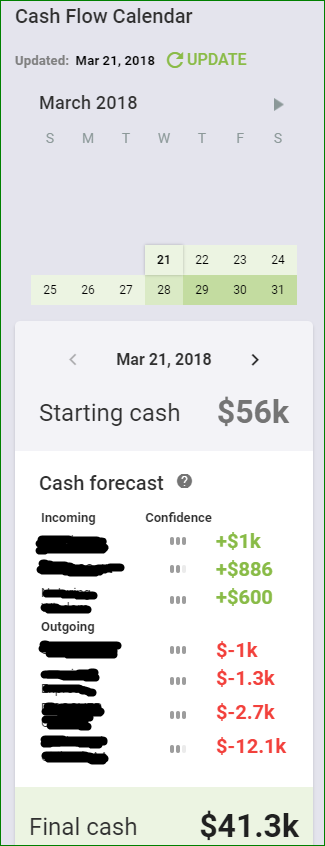

When first looking at the dashboard, you will immediately notice to the left a cash flow calendar. It is displayed as a “heat map” which alerts the company when there might be cash flow problems in the next week or months. Green indicates positive cash flow balances and red showing negative ones.

Next on the dashboard, there is a section for cash flow alerts which details the most valuable accounts receivables not yet posted and the top bills not paid. Most importantly, this application as a cash flow tool forecasts by incoming payments and outgoing bills what your balance will be at the end of the month. It does this by examining historical data and displays its level of confidence on the when the payment will be received for each item.

Here, you can also post messages to your team and set cash flow alerts for your email or smartphone.

There is also a document manager that can serve as a repository for all the company’s sensitive financial data when communicating with your financial institution. Think of it as Dropbox with bank level security.

Every time this cash flow tool is used, you should run the link to QuickBooks to update its forecasts. CashFlowTool.com uses security measures to protect your data including bank level 256-bit SSL encryption.

Finally, remember, just like with any other financial data, if the underlying information in your QuickBooks’ file is not correct, then the forecast and effectiveness of this cash flow tool will be affected.

Sign up for a trial and tell me how it has helped your business!