It is a myth that every entrepreneur needs outside investment to start a company. In fact, most small businesses never raise outside money to start their business. Instead, they bootstrap the entire venture themselves with the help of family and friends partially because it takes a lot less capital than people think to get started.

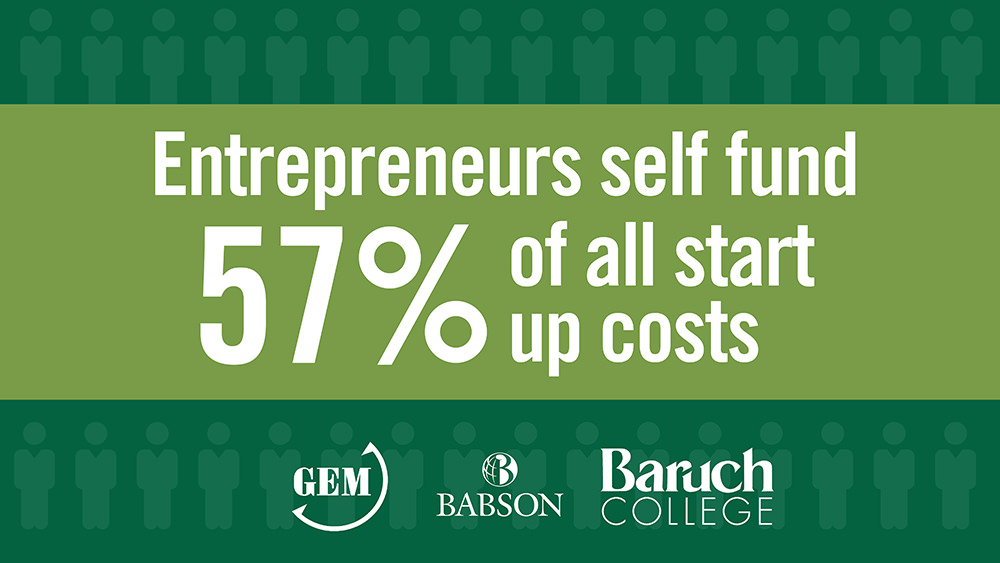

According to a new Global Entrepreneurship Monitor (GEM) U.S. Report issued by Babson College and Baruch College, in 2015, “entrepreneurs needed a median level of $17,500 to start their businesses, and financed 57% of funding needs themselves”.

What is even more amazing is they report that women needed half as much money to start companies as men.

Besides friends and family, other startup money included:

- Banks: 36%

- Government: 22%

- Crowdfunding: 12%

This is all good news for all small business owners. Entrepreneurs spend far too much time marketing their business plans looking for outside funding sources instead of delivering a product or service customers will pay now for. This is especially true for service oriented companies that require a lot less money to get started than manufacturing or biotech businesses.

This is critical since fundraising can be a full time job for the founder and a real distraction from the first real milestone they need to achieve: finding paying customers.

Despite the founder’s enthusiasm to invest, there are always ways to spend less at the start. Find what can be tested by using a small investment to get the results that are being sought that yield decisions that move the company forward. You will always wish you had some of that startup money back since as the company grows, you will have more certainty where investments need to be made than at the beginning of the journey.

With the right advice and help, like from Wegman Partners’ Colby Wegman, you shouldn’t have a problem with any of this.

How much did you spend on your last start up? List the details in the comments below.