In recent years, shopping for small business insurance for employees has become very difficult. With the new procedures and rules around the Affordable Healthcare Act, it has become nothing short of a nightmare to navigate for many small business owners.

UnitedHealthcare asked me to review their site that makes the entire process easy for the small business owner and their employees. What I found can take the dread out of insurance shopping for every small business owner who has 2 to 50 employees. UnitedHealthcare has created a first of its kind online shopping experience that gives small businesses all the shopping advantages of a larger corporation.

The process to find the right small business insurance was very simple:

Enter the company’s zip code.

Enter the number of employees. Detail on ages, gender, spouses and children are entered later.

Select benefits. Decide the plans that employees should be offered. Each one has a provider search by people, place and service which is critical. The company can offer multiple plans for employees to choose from for their insurance.

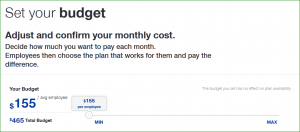

Set budget. The business owner decides how much of the cost (or percentage) they want to pay in order for their employee to make their choice of plan based on the employer’s contribution.

There is a number to call at the bottom of the screen for the state where your business is located throughout the process. UnitedHealthcare also provides instructional videos if further help is needed.

Once the small business owner makes a final insurance choice, UnitedHealthcare’s site then will be able to assist employees by taking them through a personalized experience that matches their lifestyle with the best insurance choice (coming in December 2016).

This site can help every small business owner make the best choice for their employees and company. Their team will even thank them for it!

This post is sponsored by UnitedHealthcare.