While traditionally in the past, many growing companies have turned to their local bank to seek funding options, there are now more reliable and quicker resources to secure the cash they need now right from the Internet. One of the best places that my clients have been able to expand their funding options is to use the resources of Kabbage. Over the last ten years, they have provided over $4.5B in funding to 150,000 growing small business customers and offer access to lines of credit up to $250,000. They’re particularly helpful for established growing businesses that need extra purchasing power for bigger investments from equipment, expansion location, or that next big move to get unstuck.

One of my clients, Charlie Baggs Culinary Innovations (CBCI) has been a fast-growing company and their banking resources have not been able to keep up with them. Recently, they turned to Kabbage for additional funding options. They were approved for monthly payment terms which matched their cash flow investment needs. This was an advantage over other online funding options that insist on daily or weekly repayment schedules.

They use your business data to quickly analyze and automate an approval for funding. Their model looks at the full picture of your business, assessing factors that include: capacity to repay, character, and the consistency of the business. Kabbage is a simple way to identify how much extra cash your company can have available. Download the app or login to their website. Give them authorization to analyze the real-time cash flow from your company’s bank accounts, instead of gathering old banking statements or dated tax returns. Where Kabbage differs is they look at other nontraditional factors for a growing company that shows stability in the financial health of a business. They offer to analyze the trends of a company’s Google analytics (web site traffic), UPS package shipments, Shopify, Amazon, Esty accounts, payment processing systems, bookkeeping software, and more.

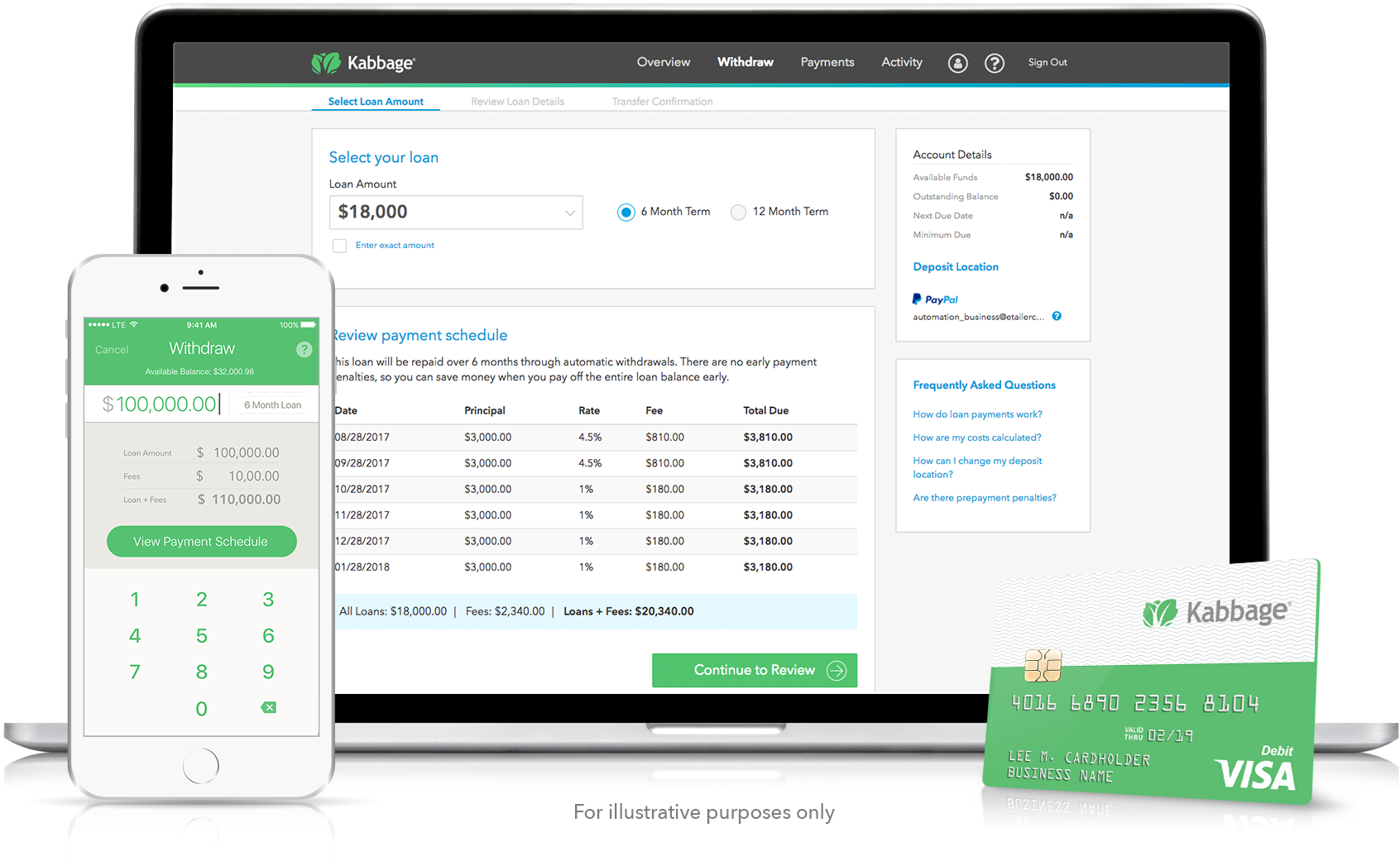

There is no fee to apply and the small business can almost immediately be approved online. They are then asked to choose the terms for their funding options. All loans are for either six or twelve months, and the month fees decrease over the full lifetime of the loan. What is especially beneficial for growing small businesses is that there are no prepayment penalties.

Don’t let the lack of funding options slow your business growth. Check out a resource that my other clients have used, Kabbage, and let me know how it helps your company.

This post is sponsored by Kabbage.