The Federal Stimulus Package (CARES Act) allocated $350 billion to help small businesses keep workers employed amid the coronavirus pandemic and coming recession. This “Paycheck Protection Program” provides 100% federally guaranteed loans to small businesses. You need to apply through any existing SBA 7(a) bank lender. Some banks are setting up their own portals to process the loans. Banks are asking for varying amounts of information (taxes, leases, payroll). This is the actual interim rule published on April 2, 2020.

FinTech lenders like Kabbage are also giving out loans to anyone, not just customers.

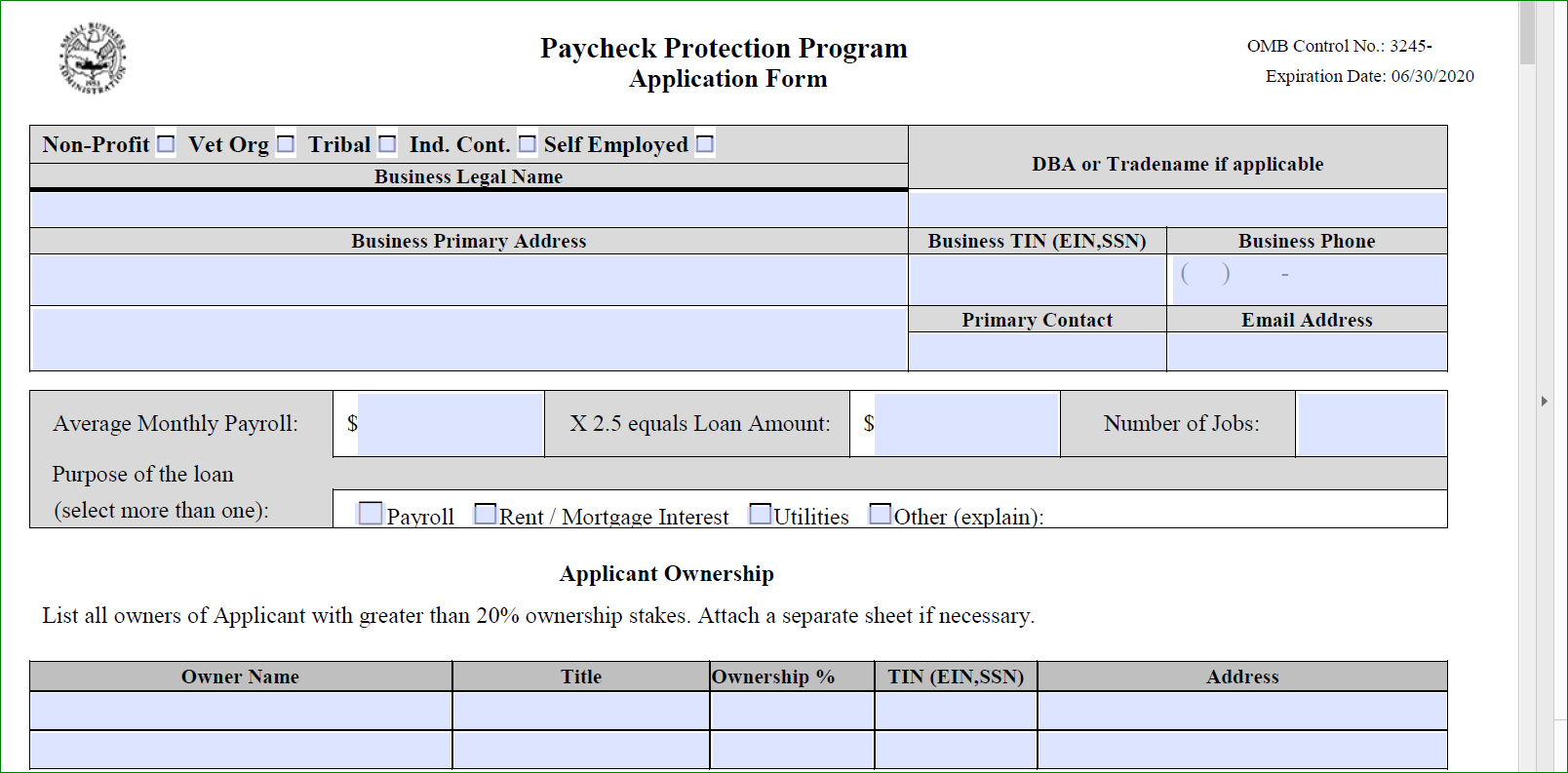

There are also services that will match you to a lender. So far, this is the sample main part of the form.

Lenders may begin processing loan applications as soon as April 3, 2020. (With the ever changing program, this post has been updated 4/1/20 but could have changed by the time you read this)

Most importantly, these loans may be forgiven if borrowers maintain their payrolls during the this time or restore their them afterward (or by June 30, 2020).

Who is eligible for the Payroll Protection Program:

- A small business with fewer than 500 employees.

- An individual who operates as a sole proprietor.

- An individual who operates as an independent contractor.

- An individual who is self-employed who regularly carries on any trade or business.

Small businesses in good faith must say that:

- The loan proceeds to retain workers and maintain payroll or make mortgage, lease, and utility payments.

- The small business does not have an application pending for a loan of this purpose.

Small business owners are not required:

- To prove they can’t get credit elsewhere.

- To provide a personal guarantee for the loan.

- To provide collateral is required for the loan.

Excluded in payroll cost:

- Compensation of an individual employee in excess of an annual salary of $100,000.

- Payroll taxes, railroad retirement taxes, and income taxes.

- Qualified sick leave wages for which a credit is allowed under the Families First Coronavirus Response Act.

How much can you borrow:

Loans can be up to 2.5 x the borrower’s average monthly payroll costs, not to exceed $10 million. Interest rate will be 1% (it was .5% but updated 4/1/20 after complaints from the banking association it was too low) and have to be paid back in 2 years but are deferred for 6 months to a year.

From the rule: “All loans will be processed by all lenders under delegated authority and lenders will be permitted to rely on certifications of the borrower in order to determine eligibility of the borrower and the use of loan proceeds.”

Small businesses are eligible to have their loans forgiven.

The small business is eligible for loan forgiveness equal to the amount the borrower spent on the following items during the 8-week period beginning on the date of the origination of the loan:

- Payroll costs (75% must be used for payroll)

- Interest on the mortgage

- Rent

- Payments on utilities

From the rule: “The lender does not need to conduct any verification if the borrower submits documentation supporting its request for loan forgiveness and attests that it has accurately verified the payments for eligible costs. The Administrator will hold harmless any lender that relies on such borrower documents and attestation from a borrower.”

As an added bonus, the amount of money forgiven will not be taxed as income.

What if I have already laid off employees or reduced their compensation?

They need to be brought back or wages need to be restored by June 30, 2020.

While the Payroll Protection Plan needs to go through an SBA Lender, you can apply for the Economic Injury Disaster Loan (EIDL) online or through a mail in form. This loan is directly provided by the SBA. You can apply for both loans but you can not accept two loans that overlap. The limits for this loan seem to have changed on April 14 limiting it to $25k for the next few months. The upfront grant portion is no only $1,000 per employee. Note there is an online form for this Economic Injury Loan (EIDL)

This chart summarizes the difference in the programs.

Other SBA Programs

The SBA also offers an Express Disaster Bridge Loan, which permits small businesses that currently have a business relationship with an SBA Express Lender to access up to $25,000. These bridge loans are meant to address the urgent need for cash while waiting for a decision and disbursement of your EIDL, and will be paid in full or part by proceeds from your EIDL loan.

Separately from the CARES Act, the Federal Reserve on March 23, 2020, announced that it expects to establish a Main Street Business Lending Program soon “to support lending to eligible small-and-medium sized businesses, complementing efforts by the SBA.”

Other Provisions of the CARES Act that can help Small Business

Delay of Payment of Employer Payroll Taxes: The bill allows some employers to defer payment of the employer share of the Social Security tax.

Employee Retention Credit: Some employers may be eligible to obtain a payroll tax credit for retaining employees during the pandemic. Eligible employers will be able to claim 50 percent of qualified wages paid up to $10,000 per employee. Businesses must be impacted by forced closures or quarantines and have seen a 50 percent drop or more in revenues in order to qualify. A business would not be eligible to take both this credit and a forgivable small business loan.

This is my reading of the information as of 4/03/20. Things might have changed by the time you read this so check with your financial adviser.

This is a good resource. I mentioned it a blog about this program on Forbes.com:

Free Money For Small Business? Beware Legal Risks Of Paycheck Protection Loan Program Until More Guidance Issued (on Forbes.com)

URL if title is not hot linked: https://www.forbes.com/sites/brucebrumberg/2020/04/06/free-money-for-small-business-beware-legal-risks-of-paycheck-protection-loan-program-until-more-guidance-issued/