As millions of businesses start to receive their Paycheck Protection Program payments (PPP) from the SBA, owners need to ensure that they spend the money in the correct way so this loan can be forgiven. Since your company received 2.5 times your monthly payroll, this loan needs to be spent in the 8 weeks from when you received the loan or June 30, 2020 (whichever comes first). This may change with the second $310B that just was approved by the Senate but so far it has not been announced.

For the loan to be forgiven, this loan money can only be spent on payroll up to $100,000 per person (75%) and other specific expenses (25%) like mortgages, rent, insurance, interest and utilities. Check with your accounting professional as to which payroll taxes can be included in your calculation and if 401K contributions can be counted.

Start by depositing the money from the PPP into a separate savings account so it does not get mixed in with general operating funds.

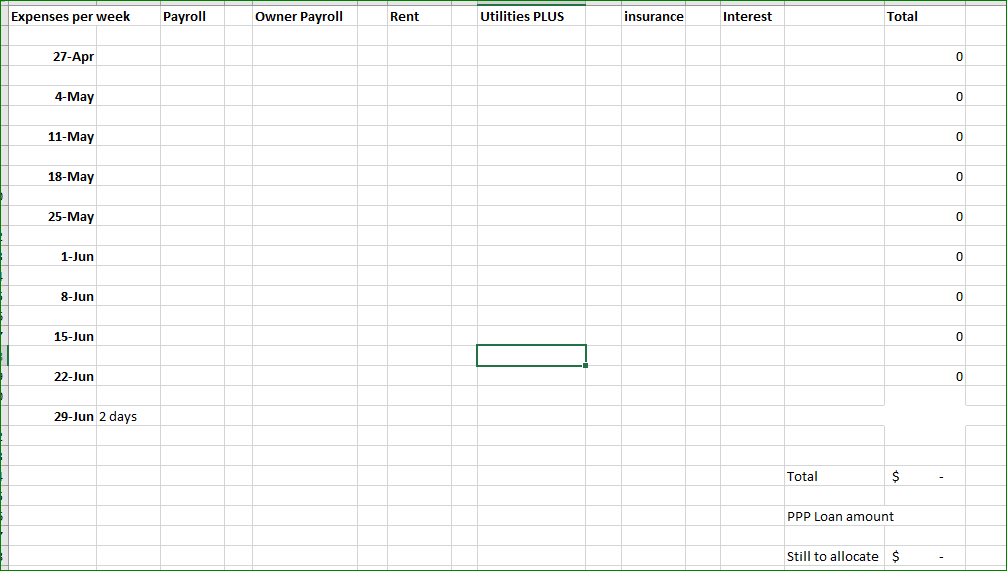

Next, set up simple spreadsheet to track qualified expenses weekly. As eligible expenses are incurred weekly, total them up and reimburse your main operating account with money from this PPP savings account. Alternately, you could tag these expenses in your financial system if it will allow you to assemble a report based on this criteria.

Your bank or lender will check back with your business in 6-12 months for your documentation on allowing loan forgiveness. This spreadsheet and withdrawals form a separate bank account will ensure you have easy to understand documentation.

A borrower must submit to the lender that is servicing the PPP loan an application for loan forgiveness, which will include documentation verifying the number of employees on payroll and pay rates for this period, payroll tax filings reported to the IRS and other expense documentation including canceled checks or payment receipts, verifying payments on covered mortgage or lease payments. For sole proprietors and independent contractors, you will need to show 1099s or money that was paid to yourself.

The lender will have up to 60 days to issue a decision on the loan forgiveness application. If this is done incorrectly, the PPP money will turn into a loan and instead of helping the business, may put it deeper into debt.

Email me if you want the actual model in Excel format or if I can help in any way.

Remember, there are two other FTE requirements for forgiveness that are discussed here.